In this article, we outline some common pricing techniques and situations in which they might be used. We also discuss how consumer psychology, product quality and advertising can affect pricing levels. If you’re unfamiliar with terms like “fixed costs”, “variable costs” and “demand elasticity”, it will help to take a quick look at our article on determining demand and calculating costs before reading this article.

Typical pricing techniques include “markup”, “target-return”, “value”, “perceived-value” and “going-rate” pricing.

Markup Pricing

The simplest pricing method is to add a fixed percentage to costs. As mentioned in our article on pricing objectives, it’s usually better to use price as a strategic tool rather than let costs determine price, but sometimes there just aren’t any better alternatives. For example, it’s common for construction companies to estimate costs for a project, and add a standard markup as profit before submitting their bids.

The simplest pricing method is to add a fixed percentage to costs. As mentioned in our article on pricing objectives, it’s usually better to use price as a strategic tool rather than let costs determine price, but sometimes there just aren’t any better alternatives. For example, it’s common for construction companies to estimate costs for a project, and add a standard markup as profit before submitting their bids.

We can illustrate numerically with another example. A microwave manufacturer expects the following costs and sales:

Variable cost per unit: $60

Fixed cost: $600,000

Expected sales: 80,000 units

The cost for each microwave (unit cost) = variable costs + fixed costs/unit sales = $60 + $600,000/80,000 = $67.50

If the manufacturer wants to markup the price by 15% on sales the price is:

Price with markup = unit cost/(1 – desired markup percentage) = $67.50/(1-0.15) = $79.41

Let’s say the manufacturer sells through a distributor who wants a 20% markup. The distributor will be charged $79.41 by the manufacturer and resell for $79.41/(1-0.20) = $99.26

Typical markups vary and are usually higher for seasonal products, slow moving products, specialty products, products with high storage costs and products for which demand is inelastic (demand stays relatively constant despite changes in price. For example gasoline and prescription drugs).

Using markup pricing is popular because easier than formulating a price by accounting for demand, competition and perceived value. Also, many feel cost pricing is fairer to sellers and buyers because sellers are not “taking advantage” of buyers when demand increases. As mentioned however, markup pricing it usually means reduced company performance.

Target-Return Pricing

With target-return pricing, price is determined based on a desired return on investment (ROI). Using our microwave manufacturer from the above example, let’s say the company invests $2 million in the business and wants to earn a 25% ROI which equals $500,000.

Target-return price is given by: unit cost + (desired return x invested capital/unit sales)

For our example: price = $67.50 + 0.25 x $1,500,000/80,000 = $72.19

This example assumes the manufacturer will sell 80,000 units but what if sales don’t reach this number or exceed it? Target-return pricing tends to ignore the effect of changing prices on demand and competition. It’s important to keep probable impacts on sales and profits with different pricing.

A handy tool is the “break-even” and “profitability” analysis. A profitability analysis lets us see what happens to profit with different sales levels. A break-even analysis lets us figure out sales levels needed to neither make a profit nor lose money.

By analysing returns in this way it also becomes obvious that finding ways to lower costs is important for increasing profits.

For break-even and profitability analysis tools please visit our profitability calculator page.

Value Pricing

Value pricing means charging a lower price for a higher quality offering. It doesn’t mean simply reducing profit margins and charging less. It means structuring the company’s operations to become a low-cost producer without sacrificing quality, enabling the company to reduce prices significantly and attract more value-conscious customers.

An important type of value pricing called “everyday low pricing” occurs at the retail level. This contrasts having temporary discounts on a regular basis after which the price is raised again. Walmart is an example of a company that deploys this pricing strategy successfully.

Perceived-Value Pricing

Instead of using costs to set price, consumer’s perception of the product’s value is used. Market research is required to determine customer perception. If your product is more durable, reliable, or you offer better service and you can communicate this to the market, a higher price may be charged successfully. Basing price on the consumer’s perceived value is a more sophisticated pricing technique that can lead to better performance.

Cost analysis is still important to determine whether what you can charge for the product will cover costs, however costs are not the driving force for price with this pricing technique.

Going-Rate Pricing

Going-rate pricing means basing prices mainly on those of the competition. It’s a popular pricing method especially when costs are hard to measure an the response of competition is unpredictable. Smaller firms will often change their pricing to match or be slightly less than the market leaders. For example, smaller gasoline retailers often set prices based on those of the major oil companies.

The above pricing methods are useful for narrowing down the final price range. There are other factors to consider, including consumer psychology, advertising and quality.

Consumer Psychology & Pricing

Consumers often use price as an indicator of product quality. This is especially true if other information about the quality of the product is not available. When alternative information about the true quality of a product is available, price becomes less important as an indicator of quality.

As mentioned earlier, demand for some types of “high-status” products such as perfume can actually increase with price.

Many believe that using a price that ends with an odd number such as $39.99 conveys the notion of a bargain or that the consumer sees the product in the $30 dollar range rather than the $40 range. However, if the goal is to convey a “high-price image” rather than a “low-price image”, it’s better to avoid using odd-ending numbers.

The Influence of Advertising and Quality

A study by Reibstein and Farris examined the relationship between price, quality, and advertising. They found that:

-

Brands with average relative quality but high relative advertising budgets were able to charge higher prices. Perhaps unsurprisingly, consumers seem to be willing to pay more for known products compared to unknown products

-

Brands with the lowest quality and lowest advertising expenditures charged the lowest prices. The inverse was also true – brands with the highest quality and the most advertising expenditures obtained the highest price

-

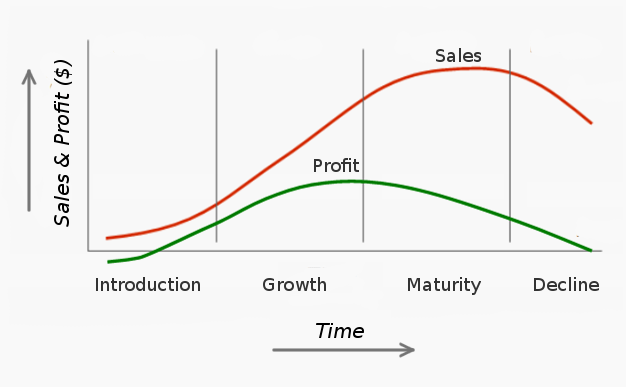

This positive relationship between high prices and high advertising expenditures were the strongest for products from market leaders that were late in their life cycle

Marketing surveys are useful tools because they can help you gather information to make more informed business decisions. How big is your target market? Will the product you’re considering launching appeal to your current customers? What are the attitudes of your customers about your company or product(s)? Surveys can help you answer these and other questions.

Marketing surveys are useful tools because they can help you gather information to make more informed business decisions. How big is your target market? Will the product you’re considering launching appeal to your current customers? What are the attitudes of your customers about your company or product(s)? Surveys can help you answer these and other questions. A “domain name” is a fancy term which simply refers to what you see in your web browser’s address bar when you visit website. Examples include “google.com”, “greenpeace.org” and our favorite website address, you guessed it, “helpsme.com”. A domain name identifies a location on the Internet where a website can be found.

A “domain name” is a fancy term which simply refers to what you see in your web browser’s address bar when you visit website. Examples include “google.com”, “greenpeace.org” and our favorite website address, you guessed it, “helpsme.com”. A domain name identifies a location on the Internet where a website can be found. The American Marketing Association defines a brand as:

The American Marketing Association defines a brand as: What makes your offering different from the rest? What can you do to stand out from the pack? This article deals with the concept of product differentiation. It’s a topic relevant to all businesses and a core marketing concept.

What makes your offering different from the rest? What can you do to stand out from the pack? This article deals with the concept of product differentiation. It’s a topic relevant to all businesses and a core marketing concept. The Concept of Competition

The Concept of Competition

Promotional pricing can help stimulate consumer interest and early purchase. It can also encourage the hesitant or unwilling to go ahead and buy. Here we outline several promotional pricing techniques.

Promotional pricing can help stimulate consumer interest and early purchase. It can also encourage the hesitant or unwilling to go ahead and buy. Here we outline several promotional pricing techniques. The simplest pricing method is to add a fixed percentage to costs. As mentioned in our article on

The simplest pricing method is to add a fixed percentage to costs. As mentioned in our article on