In this article, we turn our attention to situations where price changes might be needed and how to manage these changes.

Raising Prices

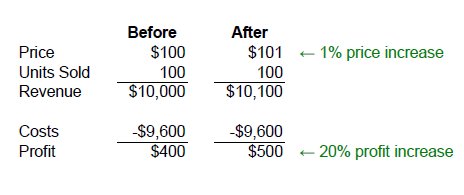

Successful price increases are can increase profitability significantly. This is especially true if profit margins are low. Let’s look at a simple example to illustrate. Below we show how a 1% price increase can result in a 20% profit increase assuming sales volume doesn’t change.

Price increases are often unavoidable in the long run because of cost inflation. As the costs of doing business (materials, labor etc.) increase, price increases follow. Inflation also adds to the risks of offering long-term price contracts.

Another common reason for price increases is for when there is more consumer demand for a product than the company can supply.

It’s important to be careful when increasing prices so as not to be seen as a “price gouger”. Consumers generally prefer prices to be raised gradually.

Besides simply increasing sticker prices sharply, “indirect” methods can be used to achieve similar results, reducing the chances of a negative impact on the company’s image:

- Reduce discounts: If discounts for bulk or early purchases are offered, these discounts can be reduced or eliminated.

- Unbundle: With unbundling, the company keeps the price as is but removes elements that were originally part of the offer. Examples include shifting from free to paid delivery, or no longer including batteries for electronic products.

- Reduce amount: Instead of raising prices, decreasing the amount of product. For example, reducing the amount of liquid in a soft drink or juice bottle.

- Reduce variety: Offering less product options or variations can reduce costs.

- Reduce features: Reducing or removing product features can reduce cost.

- Substitute materials: Finding less expensive materials to use as product inputs. For example, many candy bars contain synthetic chocolate to mitigate cocoa price increases.

Care must be taken with these approaches because if product quality and features are reduced too much, customers will notice and sales may decrease.

It’s worth pointing out that customer perceptions to price increases aren’t always negative. Customers sometimes associate positive meaning to price increases – the product is “hot” or of superb value.

Customers are most sensitive to price increases for products that are expensive and bought frequently. They often don’t notice price changes to inexpensive products that are rarely bought.

Some customers care more about the cost of the product over the total lifespan of the product. For example, sellers can charge more for products if they can convince the customer that it will be less expensive in the long run because of savings on servicing and replacement.

Cutting Prices

Several common situations can arise where you may need to cut prices.

- When market share declines, price cuts are often used as an attempt to slow or stop the decrease.

- Price cuts are also used in attempts to dominate the market. Lower prices can lead to increased sales, the hope is to achieve lower average unit costs from increased production volume.

- Prices may be reduced as a form of promotion.

- During recessions, consumers typically spend less and companies often introduce price cuts.

- As products become older or obsolete, fewer customers remain interested. Price cuts can help stimulate sales.

- Manufacturers with excess plant capacity often cut prices to increase sales if they can’t do it through product improvement or additional sales efforts.

Be Careful!

It’s important to be careful when cutting prices as there are potential negative consequences:

- While a low price can help gain market share, it does not help gain customer loyalty. Usually, customers gained by cutting prices will be lost to competitors with even lower prices.

- Customers may assume the product quality is low or that it’s faulty, or about to be replaced by a new model.

- Price cuts can result in price wars, which hurt all businesses involved. Companies with less cash reserves are particularly vulnerable in price wars because they have less “staying power”.