The cash budget is an essential tool for short-term financial planning. It shows you how cash flows in and out of your business, so that you can figure out what your company’s short-term financing needs (and opportunities) are. With a cash budget, you can get a better idea about what your company might need to borrow in the short-term. Crucial, if you want to avoid cash-flow problems.

The cash budget is an essential tool for short-term financial planning. It shows you how cash flows in and out of your business, so that you can figure out what your company’s short-term financing needs (and opportunities) are. With a cash budget, you can get a better idea about what your company might need to borrow in the short-term. Crucial, if you want to avoid cash-flow problems.

This article explains cash budgeting using an example. We’ll create a quarterly cash budget for a one year period. Although, in practice, you could create one for any reasonable time period (60 days, 90 days etc.).

Cash Budgeting Example

Let’s say your company is a toy distributor called Toy Inc., and you sell mainly to retail stores on credit, so that sales do not generate cash immediately.

Other assumptions:

- Toys Inc.’s fiscal year starts on July 1st

- Sales are seasonal. Peak sales are in the second quarter because of Christmas.

- Toy Inc. Has a 90 day collection period, and 100% of sales are collected during the following quarter

- Accounts receivable at the end of the fourth quarter of the previous fiscal year is $1 million

- Collections (of accounts receivable) in the first quarter of the current fiscal year are $1 million

The first quarter sales of the current fiscal year of $10 million are added to the accounts receivable, but $10 million of collections are subtracted. This means that Toys Inc. Ended the first quarter with accounts receivable of $10 million.

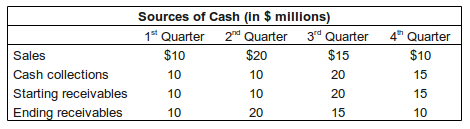

The table below shows collections for Toys Inc. for the next four quarters. In our example, the only source of cash is the collection of accounts receivable. In reality, cash could come from other sources such as sales of assets, long-term financing, and investment income.

Cash Outflow

Once cash inflow dealt with, we look at cash outflow. Cash disbursements can be put into four basic categories:

-

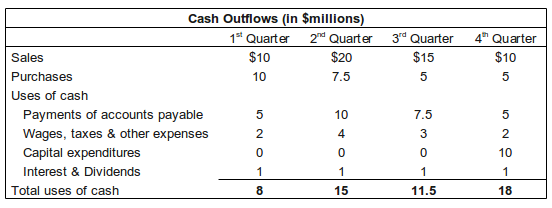

Payments of accounts payable. These are payments for products or services that Toy Inc. has bought on credit. Purchases will depend on the sales forecast. For toy Inc., let’s assume that:

- Payments are equal to last quarter’s purchases

- Purchases are equal to half of next quarter’s sales forecast

- Payments of wages, taxes and other expenses. This category includes all other normal costs of doing business for which payments are made. Depreciation is not included because it does not involve cash outflow.

- Capital expenditures. These are payments made for long-term assets like equipment and buildings. In this example, let’s say Toys Inc. Plans a major capital expenditure in the fourth quarter.

- Long-term financing. This includes interest and principal paid on long-term debt as well as dividend payments to shareholders.

To show cash outflows, we create a table shown below:

The Cash Balance

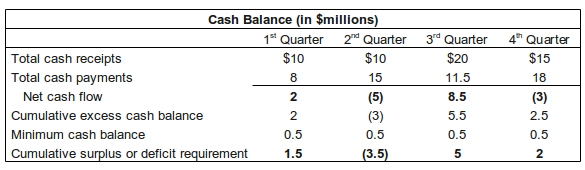

Finally, we put cash outflows and inflows together in another table. Below, we see that a large cash outflow is forecast in the second quarter. This isn’t because of an inability to earn profit, rather, it’s because of delayed collection on sales. This results in a cash shortfall of $3 million in the second quarter.

Let’s say Toys Inc. has established a minimum operating cash balance of $0.5 million to protect against the unexpected and to facilitate transactions. This means the shortfall in the second quarter is equal to $3.5 million.

What-If Analysis

Once you have a best guess estimate for your cash budgets, you could take it further by tweaking conducting a “what-if analysis”, or “sensitivity analysis”. For example, you might substitute best-case and worst-case values for the sales forecast, and see how it affects your cash budget.