Product Demand

Different prices for a product result in different levels of consumer demand. Assuming consumers are rational, increasing the price of a product results in a decrease in the number of consumers who are willing to pay that price. In other words demand decreases when price increases. Of course, the world is not a rational place and there are situations where increasing price can increase consumer demand. In the case of some prestige goods like perfume and luxury cars, demand has been shown to sometimes increase when prices were increased. However, in the case of what economists call “normal goods”, price increases tend to cause decreases in demand.

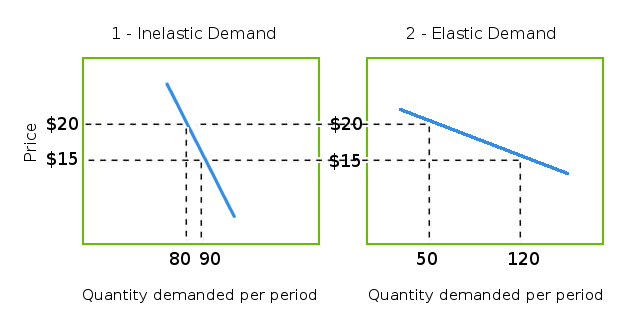

We can’t escape a small amount of jargon here. A measure of just how much demand changes with price is called “elasticity of demand”. If a product’s demand for a product changes a lot with price, demand is said to be elastic. If demand does not change too much with price, demand is said to be inelastic.

Examples of products for which demand is relatively inelastic in the short term include gasoline and cigarettes. This is because it’s difficult to find substitutes for gasoline to fuel most cars and for smokers to quit, especially in the short run. Products for which demand is relatively elastic include soft drinks such as Coca Cola and Mountain Dew.

For those who prefer visual representations of elastic an inelastic demand, please see the “demand curves” graph below. In case 1, demand is inelastic, so changes in price result in small changes in demand. In case 2, changes in price result in larger changes in demand.

In the book “The Strategy and Tactics of Pricing”, Thomas Nagle and Reed Holden outline factors that influence a buyer’s sensitivity to price. Buyers are less sensitive to price when:

-

They are less aware of product substitutes

- They are less can’t easily compare the quality of product substitutes

- The product is distinct or unique

- The lower the price is as a percentage of total income

- Part of the cost is borne by another party

- The product is used in conjunction with assets bought previously

- The product is assumed to have more prestige, quality or exclusiveness

- They cannot store the product

Estimating Product Demand

Some companies statistically analyze previous prices, quantities sold, and other factors to estimate their relationships. A second approach (more feasible for most smaller businesses) is to experiment with prices. A temporary sale can be used to see if demand, sales, and profit increase. If so, the lower price can later be adopted as the permanent price.

When experimenting with prices, it’s important to keep other factors constant so as to be sure that price is the main variable. Equally important is keeping an eye on competition to see if there have been responses as this will affect demand as well.

Estimating Costs

Companies have to charge a price that will cover their costs in the long run. Otherwise bankruptcy is inevitable. To determine a product’s cost, it’s helpful to break up the cost up into two parts. Costs that vary with the amount of product produced, and those that stay fixed regardless of how many are produced.

Variable Costs

Costs that vary with production levels are called “variable costs”. For example, Ford uses materials like metal and plastic to build cars. The more cars Ford builds, the more metal and plastic it needs to pay for.

Fixed Costs

Costs that remain fixed in the short run are called “fixed costs”. Examples of fixed costs are rent, insurance, and equipment. (All costs are variable in the long run.)

Total Cost

Total cost is simply the sum of all variable costs and all fixed costs for a given level of production. The average cost of the product is the total cost divided by the number of units.

By determining fixed and variable costs, a “breakeven point” can be found. The breakeven point is the number of sales at a given price required to cover all fixed and variable costs. For more information on calculating break-even points and profitability, please refer to our profitability calculator page.